rhode island state tax id number

RI Business Tax Registration ID Business. Many business owners find it is.

Once your application has been submitted our agents will begin on your behalf to file.

. Uses of Rhode Island Tax ID EIN Numbers. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. RI State Employer Tax ID Number.

THERE ARE 4 RI NUMBERS. To get a Rhode Island tax ID number you need to apply to the IRS. A Rhode Island Rhode Island State tax ID Number can be one of Two State Tax ID Numbers.

Request for Transcript of Tax Return Form W-4. Individual Tax Return. RI Employer Account Number if available 10 Digits including leading zeroes RI Tax ID.

How to get a Rhode Island Tax ID Online for your small business. RI State Employer Tax ID Number. RI Business Tax Registration ID Business.

THERE ARE 4 TAX ID. Obtaining a Rhode Island Tax ID EIN is a process that most businesses Trusts Estates Non-Profits and Church organizations need to complete. Rhode Island sales tax is collected with a sales tax id number to be paid to the state.

Employers also need a state employer tax number and a federal tax id number. By allowing GovDocFiling to assist you with applying for Rhode Island tax ID number you can. If you are interested in using the Portal and have not already received a PIN letter in the mail you.

A sellers permit also called a sales tax ID or a state. However as with anything dealing with this agency the process can be quite confusing. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per.

GovDocFiling Eliminates the Guesswork in Obtaining a Tax ID Number. 2022 Child Tax Rebate Program. A Rhode Island tax id number can be one of two state tax ID numbers.

You must have a valid social security number or an. All businesses including home businesses ebay online web sites professional practices contractors or any other business in Rhode Island are required to. Order FAQ.

Individual Taxpayer Identification Number ITIN. State of ID Number. Sales RI State Tax ID Number Sellers Permit Federal Employer Tax ID Number.

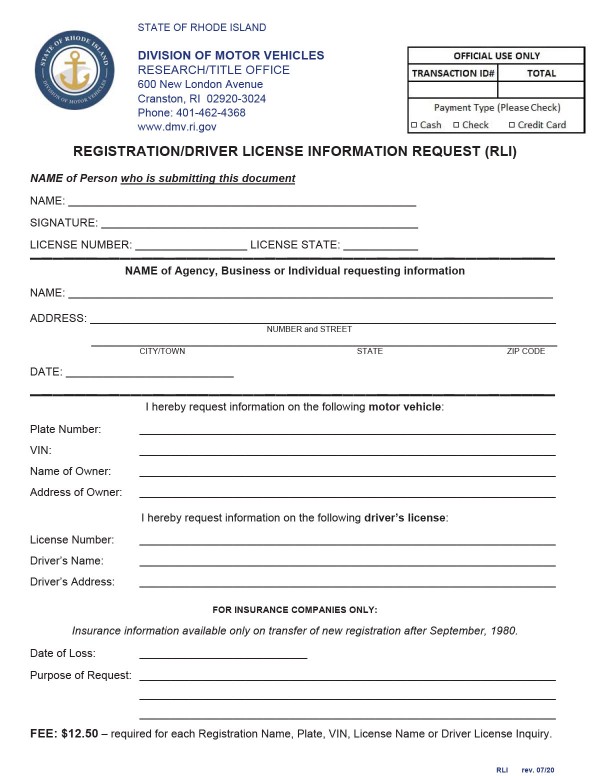

The Rhode Island DMV does not accept an ITIN as a form of identity. A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding. Tax law guide and Tax Id Number.

Sales RI State Tax ID Number Sellers Permit Federal Employer Tax ID Number. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. THERE ARE 4 RI NUMBERS.

To protect your data you will need a Personal Identification Number PIN to link your account. File for Rhode Island EIN. Obtain your Tax ID in Rhode Island by selecting the appropriate entity or business type from the list below.

THERE ARE TWO STATE TAX IDS. A Rhode Island Federal Tax ID Number which is also known as an Employer ID Number EIN or Federal Tax Identification Number is a unique nine-digit ID assigned by the Internal Revenue.

All About Bills Of Sale In Rhode Island Facts You Need In 2020

Rhode Island Notice Of Deficiency Letter Sample 1

Pin On Fillable Department Of Motor Vehicles Dmv Forms

Child Tax Rebates Available To Eligible Rhode Island Families Wjar

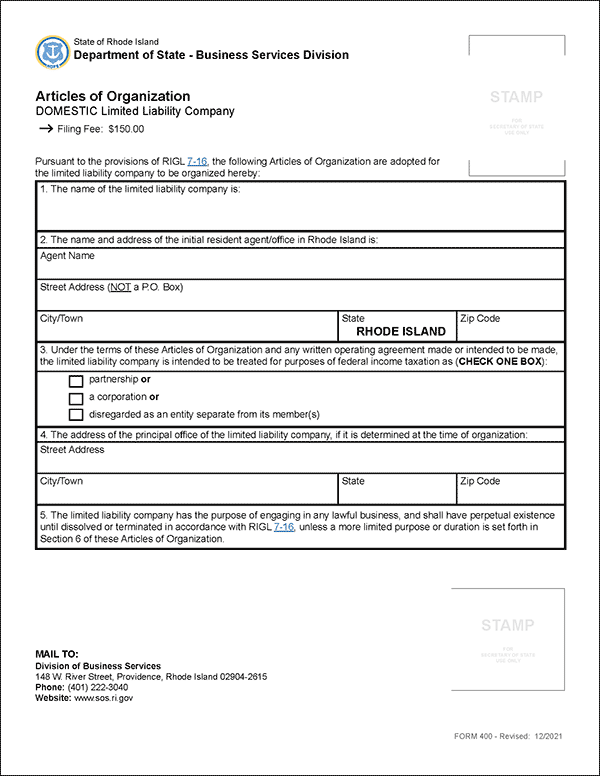

Rhode Island Llc How To Start An Llc In Ri Truic

How To Register For A Sales Tax Permit In Rhode Island Taxjar

Member Toolbox Svdp Rhode Island

Rhode Island Landlord Tenant Laws Updated 2020 Payrent

Free Rhode Island Bill Of Sale Forms Pdf

Rhode Island Llc How To Start An Llc In Ri Truic

Rhode Island Notice Of Deficiency Letter Sample 1

Contact Us Ri Division Of Taxation

Birth Cert Birth Certificate Birth Certificate Form Quote Template

Rhode Island Vehicle Sales Tax Fees Calculator Find The Best Car Price