venture capital jobs london

I Squared Capital is an independent global infrastructure investment manager focusing on energy utilities telecom and transport in North America. The latest KPMG Venture Pulse Survey showed that 41 deals were completed during the first three months of the year.

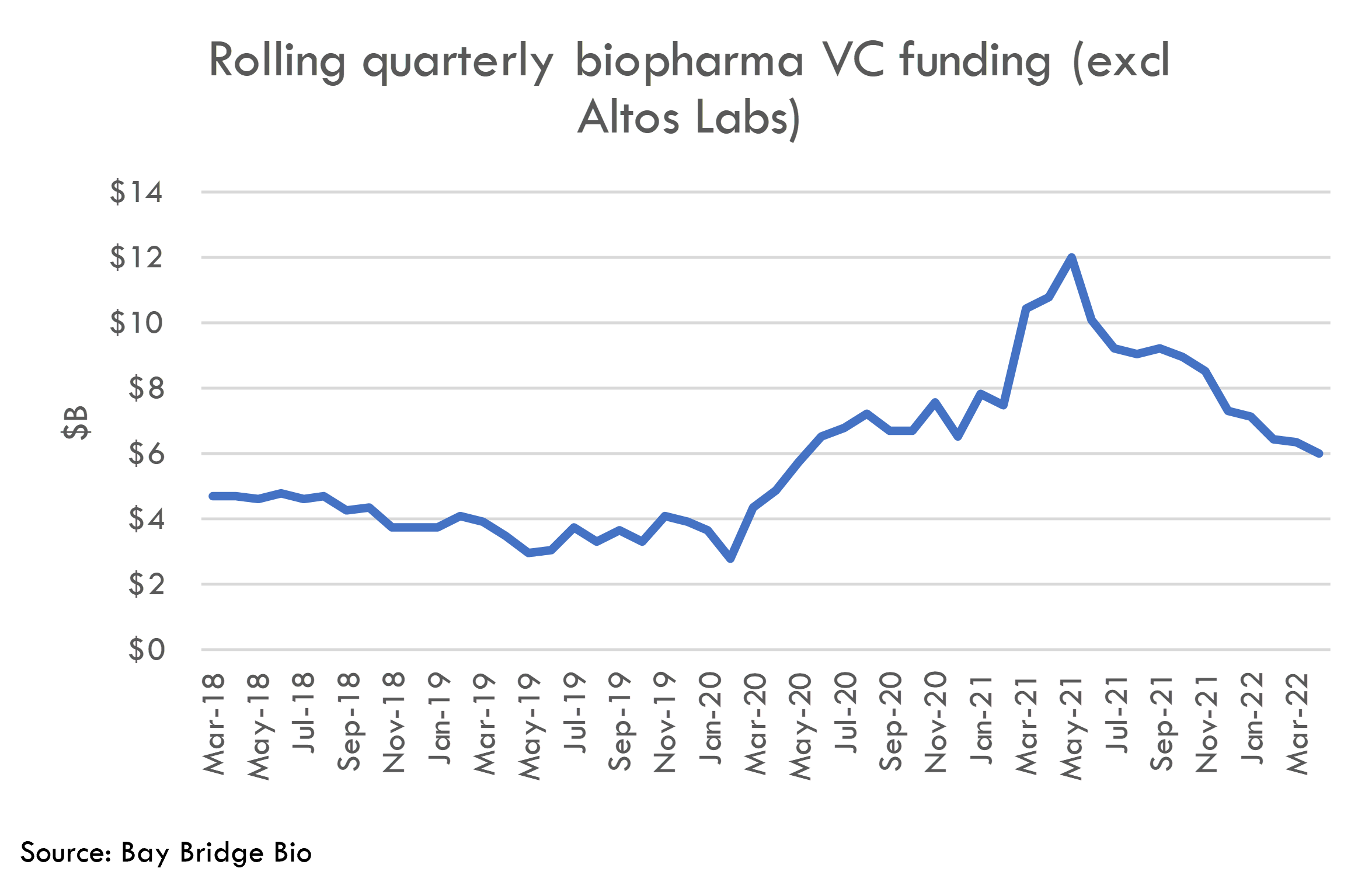

Venture Capital S 2022 Slowdown In 4 Charts Fortune

It comes as new research showed that Londons venture capital investors have been tempting staff away from traditional finance to keep up with a boom in investment in the past year which saw.

. The time between. White Star Capital is a global multi-stage technology investment platform that invests in exceptional entrepreneurs building ambitious international businesses. Venture capital investment in Scottish firms hit 181m in the first quarter of 2022 compared to 64m raised during the same period last year.

Operating out of New York London Paris Montreal Toronto Tokyo and Hong Kong our presence perspective and people enable us to partner closely with our founders to help them. Venture Capital Finance Reference. In that role he served as interim CFO for multiple Venture Funds and Startups throughout the country.

A key difference between private equity and venture capital is that private equity firms usually purchase the entire company whereas venture capitalists only get a portion. This private equity and venture capital firm specializes in providing incubation seed money and growth capital to start-up companies in the healthcare sector. In the previous quarter 31 deals worth 976m were recorded.

Finance Real Estate and Health Technology Companies. Fuel Ventures Limited is the appointed representative of Sapphire Capital Partners LLP who are authorised and regulated by the Financial Conduct Authority with firm reference number 565716. A decade ago I raised a series A venture capital round for my super early stage mortgage robo-advice platform eyeOpen before I sold it to Aegon Transamerica two years later.

At least 2 Million. It should be done only as part of a. Venture capital and bank loans finance less than 20 of new businesses.

Rich Duda served as both Director and Controller of Fund Accounting for ff Venture Capital between 2013 and 2016 and rejoined at CFO in 2018. A Charleston-based venture capital fund run by female and minority partners has raised 102 million to invest in early-stage technology businesses that develop products and services from so-called. They are looking to add a Fund Finance Valuations Manager to their team in London as they embark on their fourth fundraise where you will be responsible for all portfolio valuations and taking ownership of the.

The book is a fascinating read and illustrates well one of its core themes that venture capital is a network that straddles and offers the virtues of both markets and corporations AnnaLee Saxenian dean of the School of Information at University of California Berkeley A fascinating journey through the tightly networked world of the. Finch Capital is a Thematic Growth Investor in technology companies in Finance Real Estate and Health run by exceptional entrepreneurs. 10663 Our client is a leading venture capital investor in the gaming industry in both Europe and North America.

IMPORTANT NOTICE Investing in start-ups and early stage businesses involves risks including illiquidity lack of dividends loss of investment and dilution. If they dont get 100 at the very least a private equity firm will secure the majority share effectively claiming autonomy of the company. Financing structures like revenue-based financing and innovations like equity redemptions character-based lending and crowdfunding are.

Domain Associates is one of the largest MedTech venture capital firms in the United States having invested nearly 1 billion in over 260 medical device companies over its 30 year history. PitchBook is the premier resource for comprehensive data on the global capital markets and proprietary research and insights designed to empower your best work. UK venture capital firms have also had a record year and raised 7 billion with record-breaking fundraisings from London firms including Index Ventures Balderton Capital 83North and Eight Road.

During his time away from the company he worked for Early Growth Financial Services as a Consulting CFO. I Squared Capital 9874 followers on LinkedIn. For the rest a parallel market of equity debt and hybrid capital is rising to grow businesses create jobs and generate wealth.

Private Equity Venture Capital Jobs

Ranked The Most Prominent Vc Investors 2021 Dealroom Co

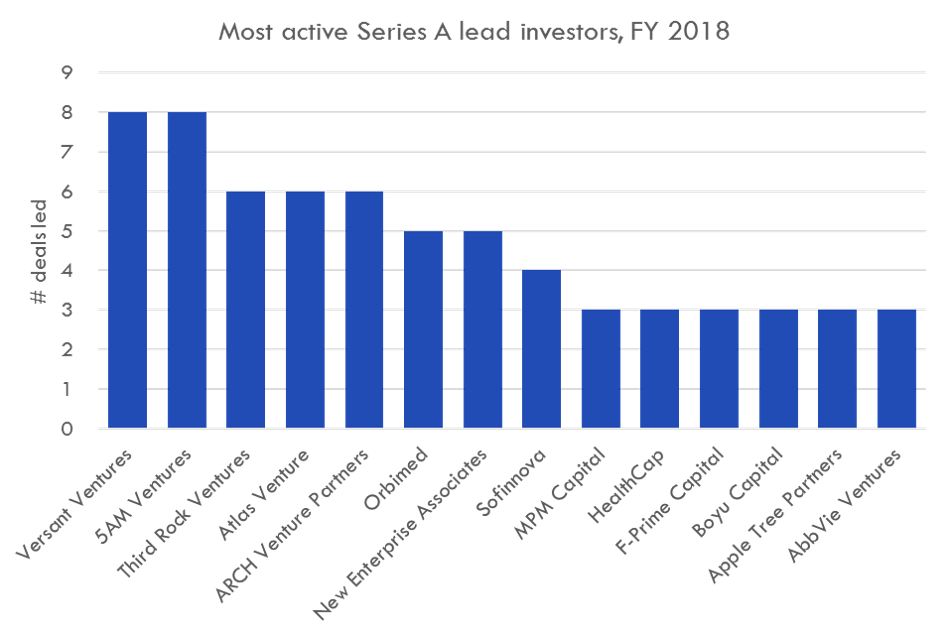

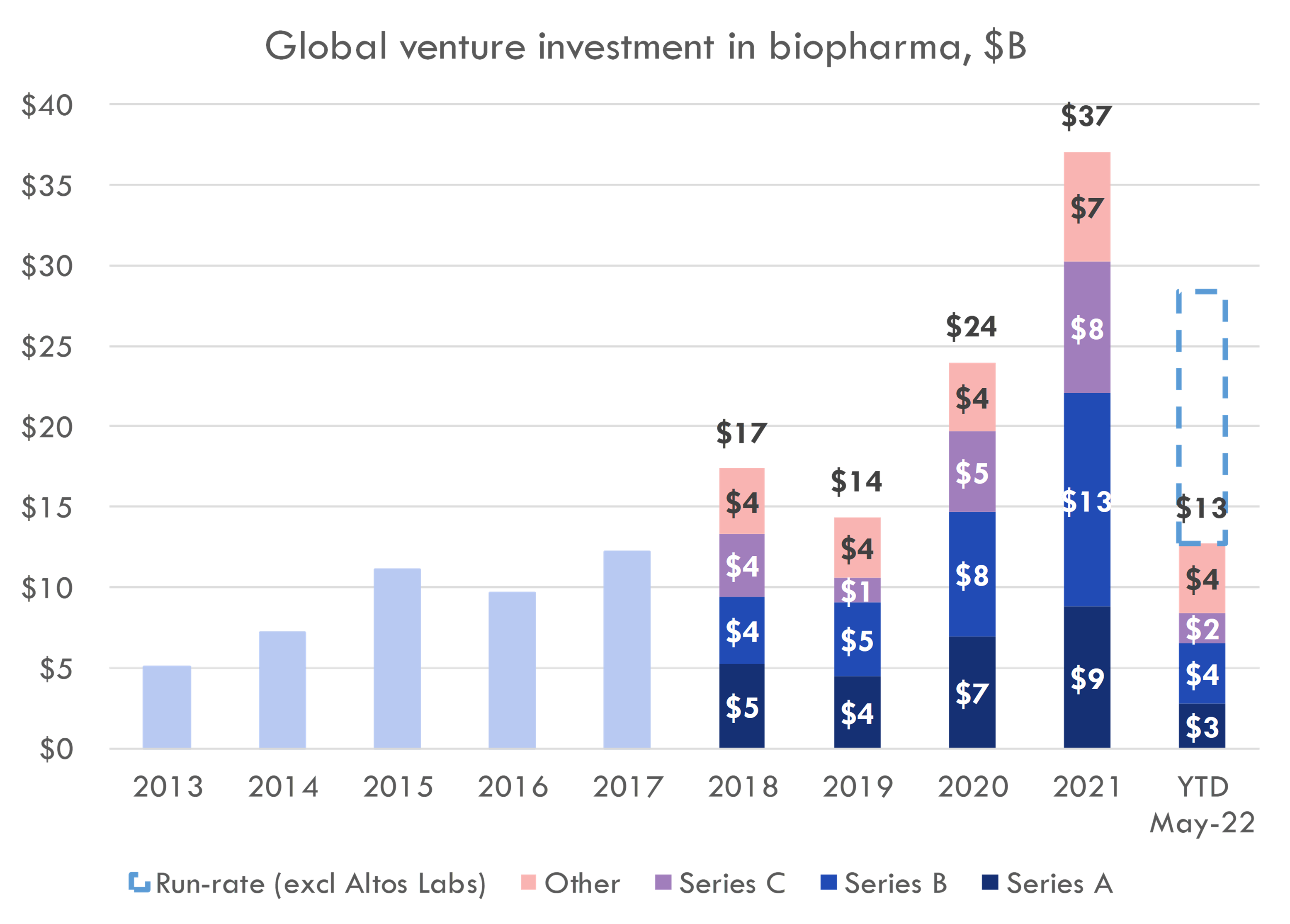

Top Biotech Venture Funds 2018 2021

Top Biotech Venture Funds 2018 2021

Top 47 Most Active Venture Capital Firms In India For Startups

The Bright New Age Of Venture Capital The Economist

Venture Capital Jobs Startup Vc

Venture Capital Careers Work Salary Bonuses And Exits

Venture Capital Jobs Startup Vc

Venture Capital Careers Work Salary Bonuses And Exits

Top Biotech Venture Funds 2018 2021

The 2021 Venture Capital Numbers Are Simply Mind Boggling Record Investments Recorded In Washington State Geekwire

The 2021 Venture Capital Numbers Are Simply Mind Boggling Record Investments Recorded In Washington State Geekwire

Venture Capital Careers Work Salary Bonuses And Exits

Vcs Investing In Food Bev Startups Visible Vc

How To Get Into Venture Capital Recruiting And Interviews Full Guide

How To Get Into Venture Capital Recruiting And Interviews Full Guide

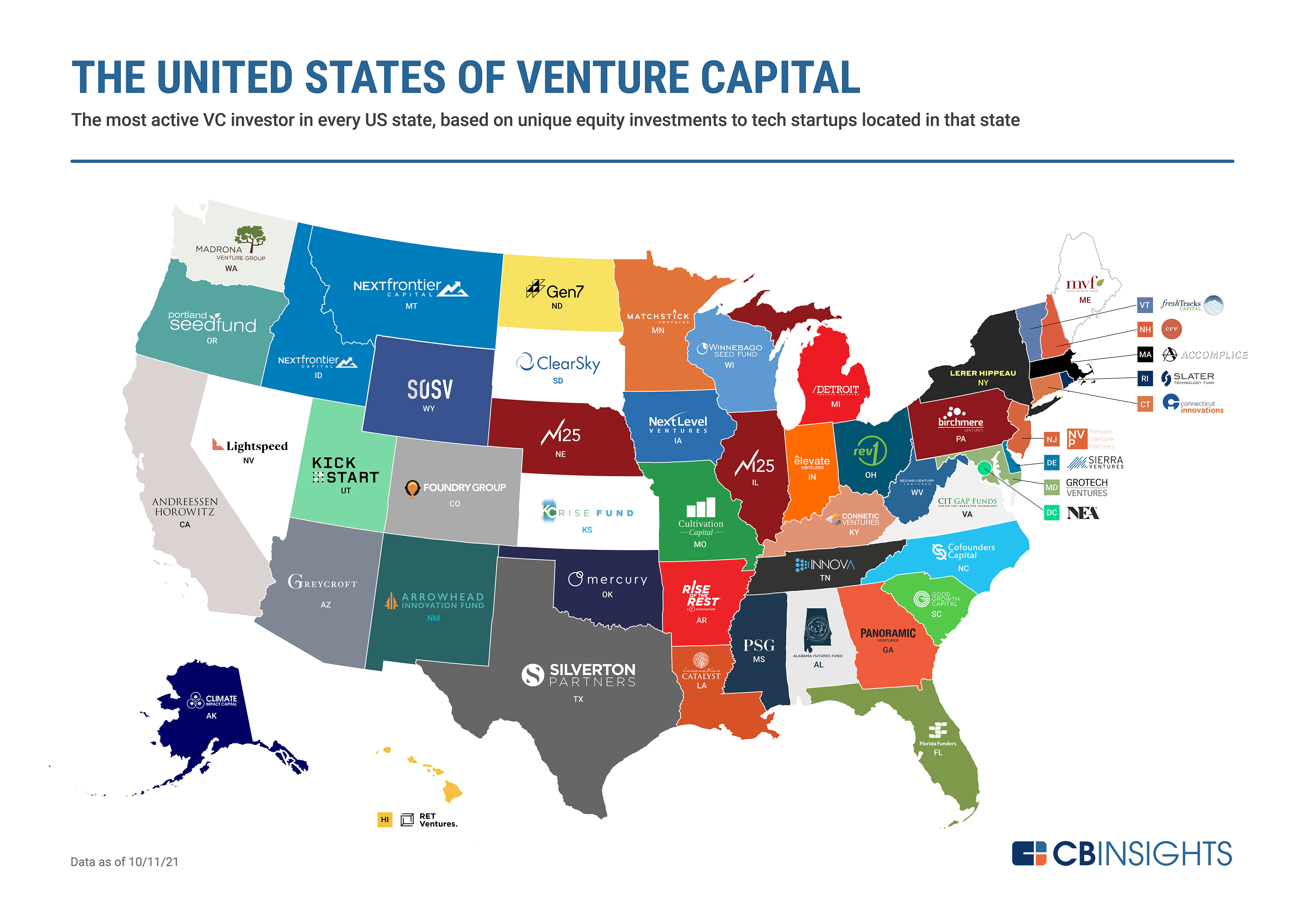

The United States Of Venture Capital The Most Active Vc In Each State Cb Insights Research